What’s a Trailing Stop?

A trailing stop is a modification of a typical stop order that can be set at a defined percentage away from the latest market price. In other words, the trigger price of trailing stops will move in line with the market price.

When setting trailing stops, traders need to set a stop loss value to trail the price (aka. price distance) instead of a stop loss price. This value shall always be positive, representing a fixed distance between the stop loss trigger price and the latest market price. Simply put, for buy trailing stop orders, the stop loss trigger price = the market price + price distance; for sell trailing stop orders, the stop loss trigger price = the market price - price distance.

For example, if you place a buy trailing stop order (a buy trade to be issued to stop loss) to your BTC short positions with a price distance of $100, the trigger price of the trailing stop order equals the market price + $100. When the market rises and the BTC price increase reaches $100, the trailing stop will be triggered, which means a buy trade will be executed at the market price. When the market starts to fall, the trailing stop price of the order will drop following the market trend and the order will not be triggered. It works the same way if you place a sell trailing stop order (a sell trade to be issued to stop loss) to your BTC long positions with a price distance of $100. The trigger price equals the market price - $100. When the market falls by over $100, a sell trade will be issued at the market price. When the market rises, the trailing stop price will rise and stop loss will not be triggered.

Trailing Stop Examples

I. Buy trailing stop order

Assume you place a buy trailing stop order (a buy trade to be issued to stop loss) to your BTC short positions with a price distance of $100 when the current BTC market price is $10,000. Then, the initial trailing stop price of this order is $10,100 ($10,000 + $100) and will move in the favorable (falling) direction.

1. If BTC rises by ≥$100, a buy trade will be issued at the market price. Your BTC short positions will be closed.

2. If BTC falls, the trailing stop price will move in the same direction (fall). If BTC is down to $9,500, the trailing stop price will drop to $9,600 from the initial $10,100. As long as the BTC price is falling, the stop loss will stay $100 below the market price and the trailing stop order will not be triggered. Once the market rises, the trailing stop price will remain. For example, if the BTC price drops to $9,500 and then starts to rise, the stop price will remain $9,600. As soon as BTC rallies to $9,600, the stop loss will be triggered, which means a buy order will be executed at the market price. Your BTC short positions will be closed.

Please note that no matter how many times the market rallies upward during a falling trend, as long as the rise does not exceed the $100 price distance you set, the trailing stop order will always remain pending.

II. Sell trailing stop order

Assume you place a sell trailing stop order (a sell trade to be issued to stop loss) to your BTC long positions with a price distance of $100 when the current BTC market price is $10,000. Then, the initial trailing stop price of this order is $9,900 ($10,000 - $100) and will move in the favorable (rising) direction.

1. If BTC drops by ≥$100, a sell trade will be issued at the market price. Your BTC long positions will be closed.

2. If BTC rises, the trailing stop price will move in the same direction (rise). If BTC is up to $10,500, the trailing stop price will rise to $10,400 from the initial $9,900. As long as the BTC price is jumping, the stop loss will stay $100 above the market price and the trailing stop order will not be triggered. Once the market falls, the trailing stop price will remain. For example, if the BTC price rallies to $10,500 and then starts to drop, the stop price will remain at $10,400. As soon as BTC goes down to $10,400, the stop loss will be triggered, which means a sell order will be executed at the market price. Your BTC long positions will be closed.

Please note that no matter how many times the market moves downward during a rising trend, as long as the drop does not exceed the $100 price distance you set, the trailing stop order will always remain pending.

Understanding a Trailing Stop

A trailing stop mainly helps traders to lock in profits by adjusting the stop loss price when the market moves profitably and to limit losses when the market moves in the opposite direction.

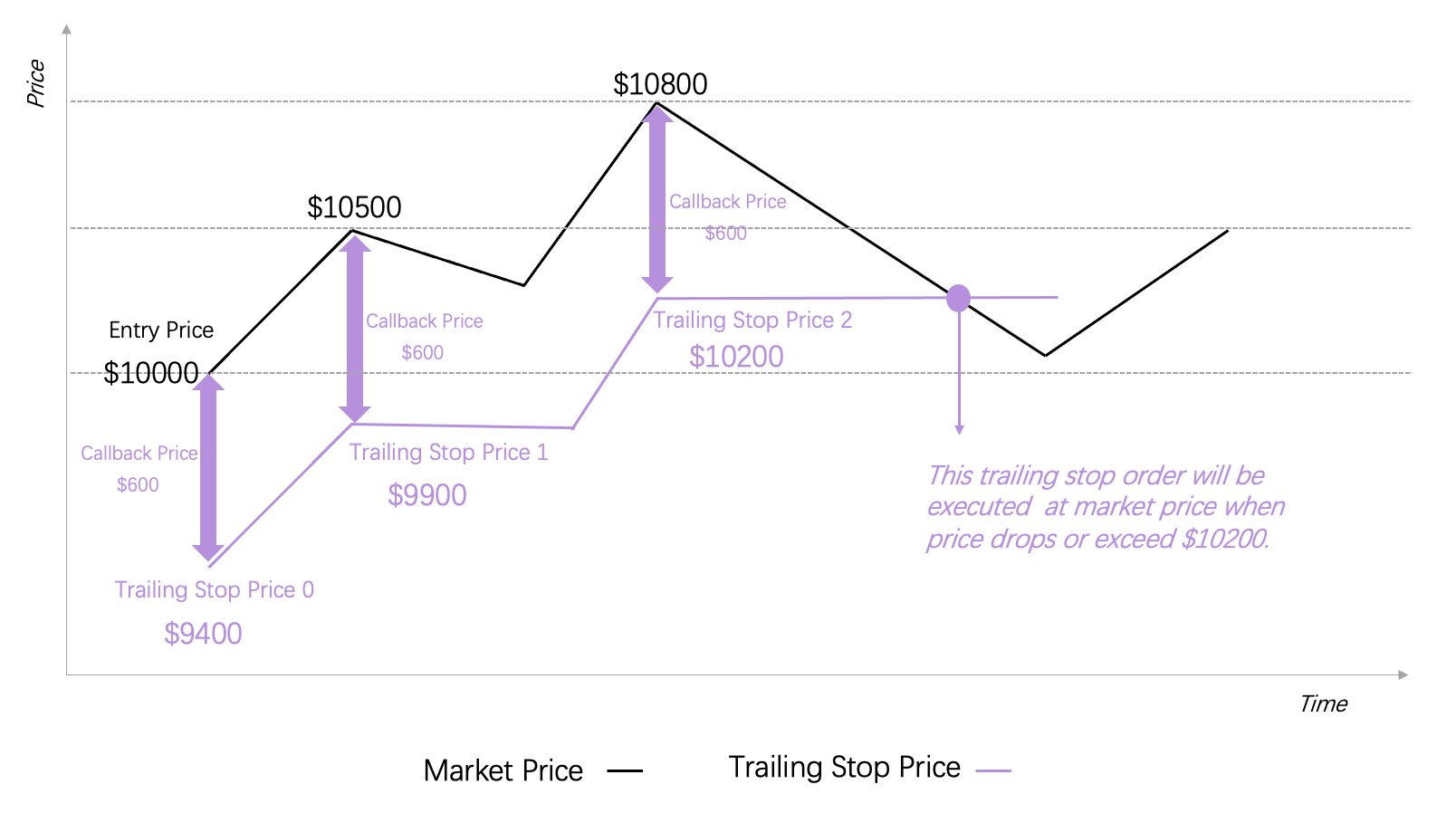

Simply put, after a trailing stop is set, if the market moves in the trader’s expected direction, the trailing stop price will also move along with it, keeping the order pending and helping the trader expand their earnings without triggering a stop loss. If the market moves in the unfavorable direction and the price change exceeds the previously set price distance, the stop loss will be triggered and the position will be closed to help the trader to pocket the previous gains in time before the market becomes more volatile. As shown in the chart below, this trailing stop order helps the trader lock in most of their gains from the previous price increase before the price falls further.

(In the chart, the price distance of the sell trailing stop order is $600. Only when the price change reaches $600, the stop loss will be triggered. However, during the rising market trend, the trailing stop price will rise.)

Therefore, a trailing stop order is also considered to be an order placed when trades are entering the profitable phase.

Note: As a stop loss order, a trailing stop order can also be used to open a position, but this is not common. When a trailing stop order is used to open a position, it works in the same way as a limit order. That is to open a position when the market moves as expected to the specified price.

Trailing Stop Order VS Stop Loss Order

As a type of stop loss order, a trailing stop, like a regular stop loss order, can help traders close their positions in time to avoid further losses.

Moreover, what sets trailing stops apart from a stop loss order is to help traders lock in profits by adjusting the stop price dynamically with the market trend as mentioned above. Trailing stops are also more flexible than stop orders because they automatically track price movements.

Note: Market prices used when trailing stop orders are executed adopt mark prices of futures.