Trading Fee for Futures

1. Overview

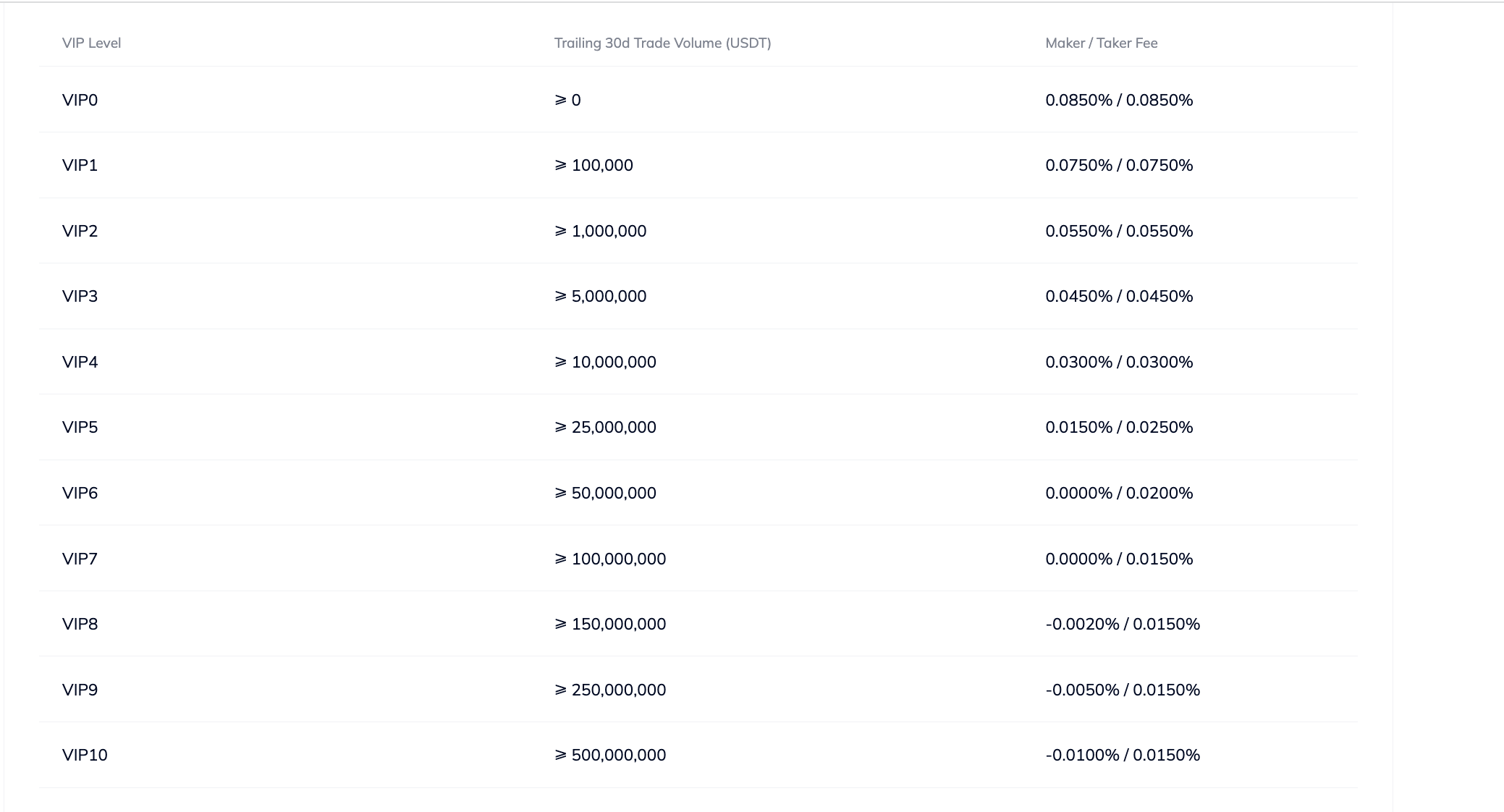

FUTX utilizes a tiered VIP trading fee structure for both traders. VIP tiers have discounts set against base trading fees and are based on trailing 30-day trade volume (in USDT) : Each user’s trailing 30-day trade volume (in USDT) will be calculated every day at 0:00 UTC based on the daily average price of each trading pair in USDT.

2. VIP Tiered Structure

Note: A maker order is defined as an order from a market participant to buy or sell an asset that provides liquidity to the order book. A taker order is defined as an order from a market participant to buy or sell an asset that removes liquidity from the order book. Taker orders execute immediately while maker orders do not. When a maker order and a taker order interact with one another, a trade is consummated. Market participants who place a maker order are referred to as “makers,” and market participants who place a taker order are referred to as “takers.”

Funding Rate for Futures

The Funding Rate is the key to narrowing down the price difference between perpetual futures market and spot market by regularly paying shorts or longs. Longs pay shorts if the Funding Rate is positive with more longs in the market, and shorts pay longs if Funding Rate is negative with more shorts in the market.

Funding is settled in USDT once every 8 hours, i.e., funding payment at 00:00 a.m., 8:00 a.m., and 4:00 p.m. on a daily basis. BTC Funding Rate is capped at (-3%, 3%). (i.e., Max Funding Rate is 3%; Min Funding Rate is -3%). The Funding Rate of other digital assets is capped at (-5%, 5%). Only upon settlement will traders with open futures positions receive or be subject to a funding fee. Traders without any positions in their accounts will not be charged with a funding fee.

The Funding Rate is updated every 60 seconds (“Predicted Funding Rate”) based on the calculation of Price Premium / Index Price. The Funding Fee is a calculation of Funding Rate * Index Price * Positions.